How to Pay Yourself: A Guide for Women Small Business Owners in Montana

March 4, 2024 •Kassi Strong

Starting a business in Montana can be an exciting journey filled with promise and potential. As a woman entrepreneur in the Big Sky Country, you're part of a growing community of go-getters shaping the economic landscape. But amidst the excitement of building your dream venture, it's essential to ensure you're paying yourself fairly. After all, your hard work deserves proper compensation. If you're wondering how to navigate paying yourself as a small business owner in Montana, fear not! Here at the Rocky Mountain Women's Business Center, we've got you covered with some straightforward steps you can follow to get started.

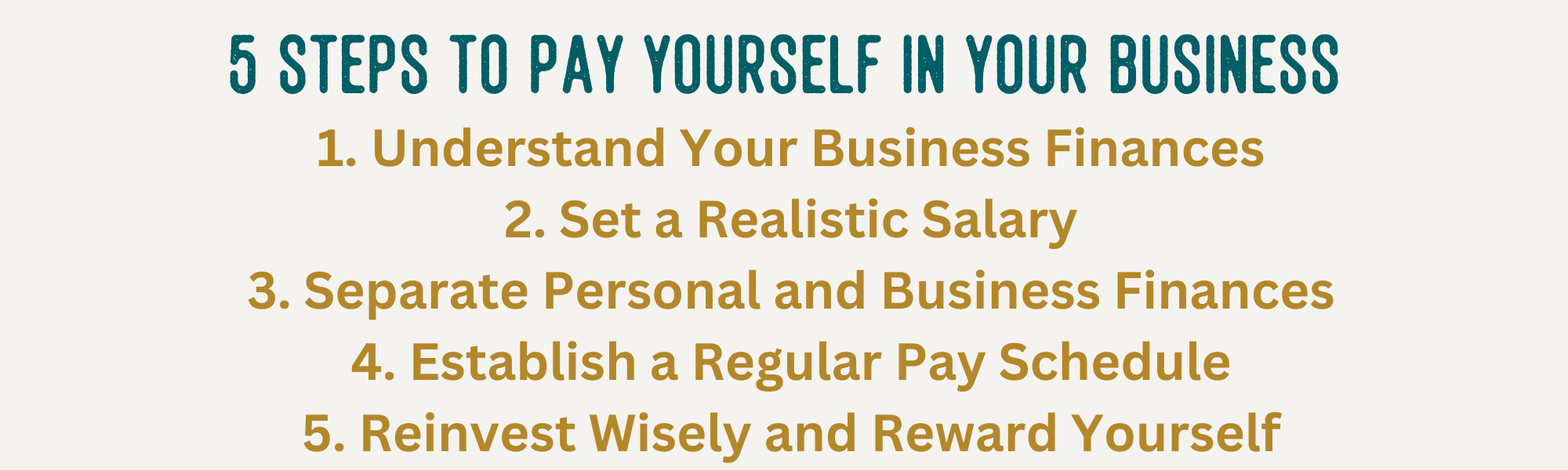

Step 1: Understand Your Business Finances

Before diving into paying yourself, it's crucial to have a clear understanding of your business finances. Take stock of your revenue, expenses, and profit margins. Familiarize yourself with basic accounting principles or enlist the help of a trusted accountant. By having a solid grasp of your financial health, you'll be better equipped to make informed decisions about your salary. If this first step feels foreign or overwhelming, you should set up a time to meet with a RMWBC Business Advisor who can help you approach your financials with confidence.

Step 2: Set a Realistic Salary

As tempting as it may be to funnel all profits back into your business, paying yourself a fair salary is essential for your well-being and financial stability. Determine a realistic salary that reflects your contributions to the company and aligns with industry standards. Consider factors such as your role, experience, and the financial health of your business. While it's okay to start modestly, aim to adjust your salary as your business grows and thrives. This step is where your personal financial goals might come into play as well. Take a look at your personal budget and consider how much you would need to be able to pay yourself to hit your personal expenses and savings goals.

Step 3: Separate Personal and Business Finances

Maintaining clear separation between your personal and business finances is key to managing your salary effectively. Open a separate business bank account to deposit revenue and pay expenses. Avoid using personal funds for business expenses, and vice versa. This not only simplifies accounting and tax preparation but also ensures that your salary payments are transparent and traceable.

Step 4: Establish a Regular Pay Schedule

Consistency is key when it comes to paying yourself. Once you understand your business's cash flow and financial obligations and your personal financial goals, establish a regular pay schedule. Whether it's weekly, bi-weekly, or monthly, stick to your chosen schedule to maintain stability and predictability. Treat your salary like any other business expense – a non-negotiable priority.

Step 5: Reinvest Wisely and Reward Yourself

While paying yourself is essential, it's also essential to strike a balance between reinvesting in your business and rewarding yourself for your hard work. Allocate a portion of your profits towards business growth initiatives such as marketing, expansion, or employee development. At the same time, don't forget to celebrate your successes and treat yourself for reaching milestones along the way. Whether it's a weekend getaway or a special dinner, acknowledging your achievements is crucial for motivation and morale.

In conclusion, paying yourself as a woman small business owner in Montana requires careful planning, discipline, and a dash of self-appreciation. By understanding your finances, setting a realistic salary, separating personal and business finances, establishing a regular pay schedule, and balancing reinvestment with rewards, you'll pave the way for financial success and personal fulfillment. Remember, you're not just building a business – you're crafting a legacy and empowering future generations of women entrepreneurs in the Treasure State. Keep blazing trails, and don't forget to pay yourself what you're worth!

Looking for some help with this process? We offer FREE business consulting, and our Business Advisor would love to help you crunch the numbers and create a plan for paying yourself. What are you waiting for? Schedule your call today!